📜

What is a Sale Deed?

A Sale Deed is a legal document that acts as proof of the sale and transfer of ownership of land/property from the seller to the buyer. Registration of the Sale Deed is mandatory under Section 17 of the Registration Act, 1908.

🛠️

Steps for Sale Deed Registration in Himachal Pradesh

-

Drafting the Sale Deed:

-

Prepared by a qualified advocate.

-

Must clearly mention parties’ details, property description, consideration amount, terms and conditions.

-

-

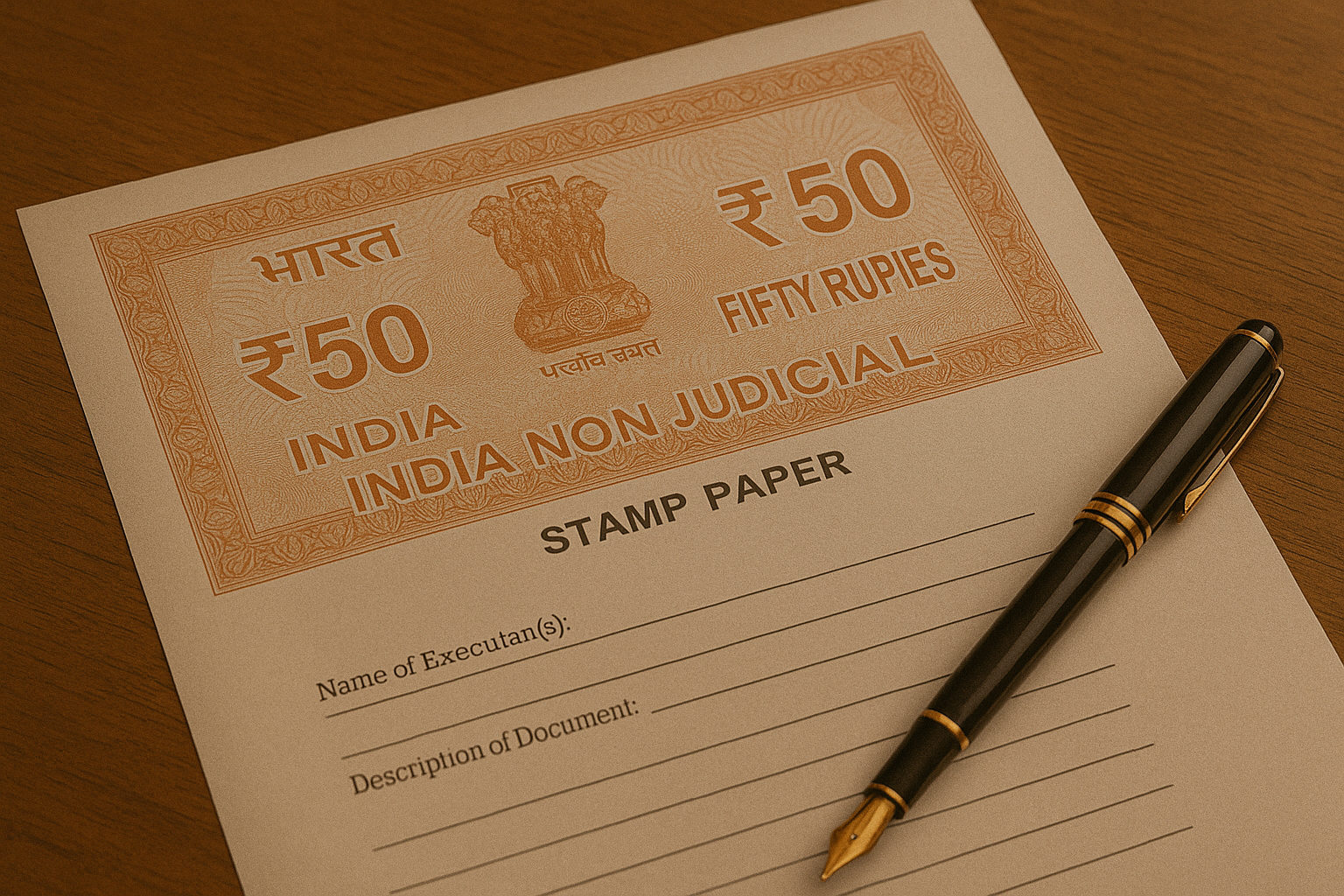

Stamp Duty and Registration Charges:

-

Sale Deed must be printed on stamp paper of the required value.

-

In Himachal Pradesh, the stamp duty typically is 5% of the sale consideration for men and 4% for women (concessions may apply).

-

Registration fee is usually 1% of the property value.

-

-

Payment of Stamp Duty:

-

Paid either by purchasing stamp papers or through e-stamping via the Stock Holding Corporation of India Ltd. (SHCIL) or the state government portal.

-

-

Visit to the Sub-Registrar’s Office:

-

Both parties (buyer and seller) must appear at the jurisdictional Sub-Registrar Office.

-

Need to carry all required documents (listed below).

-

The Sale Deed is then registered after verification.

-

-

Receiving the Registered Deed:

-

After registration, a certified copy of the Sale Deed can be obtained.

-

The original deed is handed back after the process (sometimes after a few days depending on office workload).

-

📑

Documents Required

-

Drafted Sale Deed (original + 2 copies)

-

Identity Proof of both parties (Aadhaar Card, PAN Card, Voter ID, Passport)

-

Passport size photographs

-

Latest Land Revenue Records (Jamabandi, Tatima, Intkaal copy)

-

Original Title Deed/Ownership document of the seller

-

Encumbrance Certificate (showing no pending dues)

-

NOC (if required, e.g., from society, municipal authorities)

-

Agreement to Sell (if any was made prior)

-

Power of Attorney (if signing through an agent)

-

Stamp duty and registration fee receipts

🔍

Special Points to Note in Himachal Pradesh

-

Section 118 of the Himachal Pradesh Tenancy and Land Reforms Act, 1972 applies.

👉 Non-agriculturists (those not originally residents of HP) cannot buy agricultural land without permission from the State Government.

-

Permission from DC Office might be required if the buyer is a non-agriculturist or for certain types of properties.

-

Mutation of Property:

After registration, you must apply for mutation of the land records in your name at the Tehsil office.

-

Women Buyers:

Stamp duty concessions are available for women in HP to encourage women’s ownership of property.

🧑⚖️

Why Proper Sale Deed Registration is Important

-

Provides legal ownership.

-

Prevents future disputes or fraud.

-

Necessary for obtaining loans against property.

-

Helps in mutation and tax assessments.